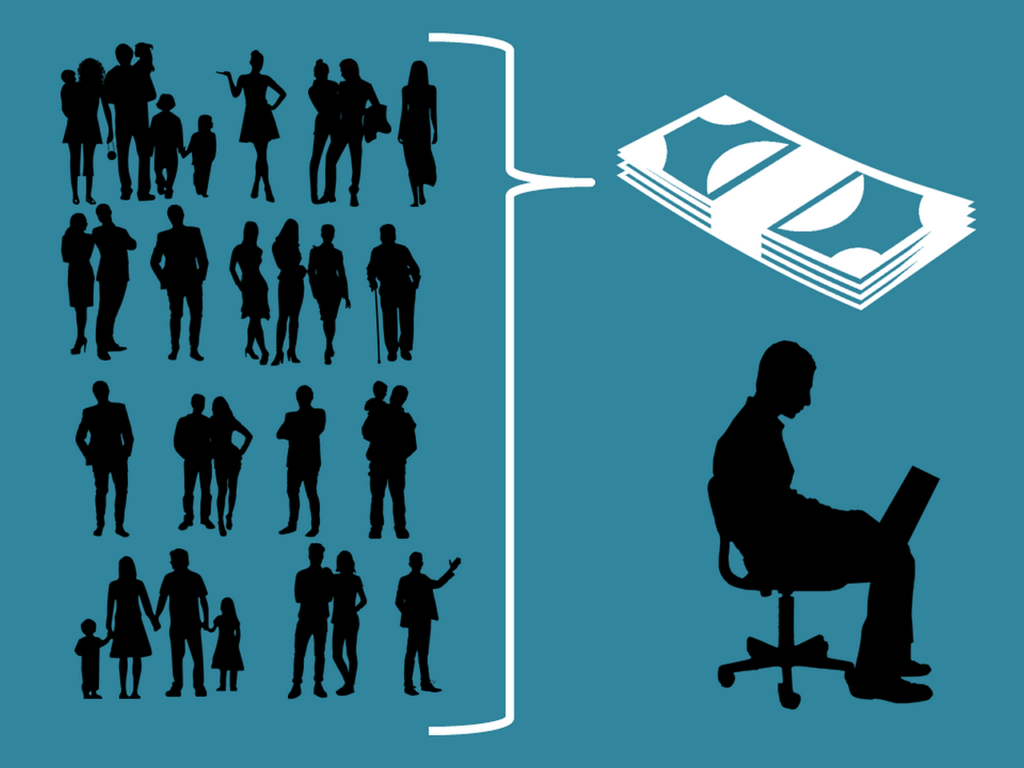

Are you curious about whether there are potentially lucrative investment opportunities in startups or small businesses? Well, look no further! In this article, we will explore the exciting world of investing in these budding ventures. Discover the potential risks, benefits, and strategies that can help you navigate this thrilling landscape. So, if you’re ready to explore the realm of startup and small business investments, read on to find out more!

Investing in Startups or Small Businesses

Investing in startups or small businesses can be an exciting and potentially lucrative opportunity. While it carries some risks, it also offers a range of benefits that can make it a worthwhile venture. By considering various factors, understanding the different types of investments available, and implementing effective investment strategies, you can maximize your chances of success in this endeavor.

Benefits of Investing in Startups or Small Businesses

Investing in startups or small businesses presents several advantages. Firstly, these ventures often have significant growth potential. By getting in at an early stage, you can benefit from the exponential growth that successful startups or small businesses can experience. This growth can result in substantial returns on your investment.

Additionally, investing in startups or small businesses allows you to be a part of the entrepreneurial journey. Many investors find the process exhilarating as they witness the development and success of a business they have supported. Being actively involved in the startup or small business ecosystem can provide opportunities for networking and learning from experienced entrepreneurs.

Furthermore, startups and small businesses often offer innovative ideas and disruptive technologies. By investing in such ventures, you can support the development of groundbreaking solutions that have the potential to change industries or even the world. This aspect can be highly rewarding both financially and personally.

Risks of Investing in Startups or Small Businesses

While investing in startups or small businesses can be financially rewarding, it also carries inherent risks. Many startups and small businesses fail, and there is a possibility of losing your entire investment. Factors such as market conditions, competition, or mismanagement can significantly impact the success of these ventures.

Additionally, the liquidity of your investment may be limited. Unlike publicly listed companies, startups or small businesses may not have a readily available market where you can easily sell your shares. This lack of liquidity can make it challenging to exit your investment when desired.

Moreover, investing in startups or small businesses requires a higher tolerance for risk. The future success of these ventures is unpredictable, and as an investor, you must be prepared for the possibility of prolonged periods without any returns. It is essential to carefully assess and diversify your investment portfolio to mitigate potential risks.

Factors to Consider Before Investing

Before investing in startups or small businesses, it is crucial to evaluate various factors that can significantly impact the success and profitability of your investment.

Market Potential and Growth

Assessing the market potential and growth prospects of a startup or small business is paramount. A thorough understanding of the target market’s size, competitive landscape, and growth trends helps you determine the viability and scalability of the venture. A large and growing market with limited competition increases the chances of success.

Competitive Advantage

A competitive advantage is crucial for the success of any startup or small business. Analyze the uniqueness of the product or service being offered and evaluate if it provides a distinct advantage over existing competitors. Strong intellectual property rights, proprietary technologies, and exclusive partnerships can contribute to a sustainable competitive advantage.

Management Team

The management team plays a vital role in executing the business plan and driving the success of a startup or small business. Evaluate the experience, skills, and track record of the team members. An experienced and capable management team increases the likelihood of effectively navigating challenges and achieving business objectives.

Financial Stability

Assessing the financial stability of a startup or small business is essential. Review their financial statements, including revenue, expenses, and cash flow projections. Consider their ability to manage costs, generate revenue, and achieve profitability. It is advisable to invest in ventures with a clear financial plan and realistic projections.

Exit Strategy

Before investing, it is important to understand the exit strategy options available. Consider whether the startup or small business has a clear plan for delivering returns to investors. Common exit strategies include acquisition by a larger company or an initial public offering (IPO). Without a viable exit strategy, liquidity and potential returns on your investment could be significantly impacted.

Types of Investments

When considering investing in startups or small businesses, it is essential to understand the different types of investments available.

Equity Investment

Equity investment involves purchasing shares of a startup or small business in exchange for ownership. As a shareholder, you have a proportional claim on the company’s assets and earnings. Equity investments provide an opportunity for long-term growth and potential capital appreciation.

Debt Investment

Debt investment involves lending money to a startup or small business in return for regular interest payments and the repayment of the principal amount. Debt investments provide more predictable returns compared to equity investments. However, they generally offer lower potential for significant capital appreciation.

Convertible Notes

Convertible notes are a hybrid form of investment that combines debt and equity. Investors provide a loan to the startup or small business, which can be converted into equity at a future date, typically upon the occurrence of specific events, such as a subsequent funding round. Convertible notes offer flexibility for both the investor and the company.

Investment Strategies

Implementing effective investment strategies can enhance your chances of success when investing in startups or small businesses.

Diversification

Diversification is a crucial strategy in minimizing risk. By investing in a diverse portfolio of startups or small businesses across different industries and stages of development, you can spread your risk. This approach helps mitigate the impact of potential failures and increases the likelihood of benefiting from successful investments.

Active vs Passive Investing

Investors can adopt either an active or passive investment strategy. Active investing involves actively researching and selecting startups or small businesses based on personal analysis and judgment. Passive investing, on the other hand, involves investing in startup or small business funds managed by professionals. Each approach has its merits, and the choice depends on your investment goals, expertise, and availability of time.

Investment Vehicles

Investment vehicles provide avenues for investing in startups or small businesses while leveraging the expertise and resources of professional investors.

Venture Capital Funds

Venture capital funds are professionally managed investment funds that pool money from multiple investors to invest in startups or small businesses. These funds have experienced investment managers who conduct due diligence, negotiate investment terms, and provide ongoing support to portfolio companies. Investing through venture capital funds allows for diversification and access to promising investment opportunities.

Angel Investors

Angel investors are typically high-net-worth individuals who invest their own capital in startups or small businesses. They often provide early-stage financing and mentorship in exchange for equity or convertible notes. Angel investors play a vital role in supporting entrepreneurs and startups, offering not only financial resources but also valuable expertise and industry connections.

Crowdfunding Platforms

Crowdfunding platforms offer a platform for individuals to invest in startups or small businesses by contributing small amounts of money. This approach enables entrepreneurs to raise funds from a large group of investors, often in exchange for equity or rewards. Crowdfunding provides an opportunity for retail investors to participate in startup investments and diversify their portfolios.

Due Diligence Process

Conducting thorough due diligence is essential before making any investment in startups or small businesses. Consider the following key steps in the due diligence process:

Assessing the Business Model

Evaluate the startup or small business’s business model to understand its revenue streams, target market, pricing strategy, and scalability. Assess the viability and attractiveness of the business model based on market conditions and competitors.

Evaluating Financial Statements

Review the startup or small business’s financial statements, including balance sheets, income statements, and cash flow statements. Analyze revenue growth, profitability, and key financial ratios to assess the financial health and stability of the venture.

Reviewing Legal and Regulatory Compliance

Ensure that the startup or small business complies with all applicable legal and regulatory requirements. Review contracts, licenses, permits, and any potential legal issues that may impact the venture’s operations or future growth.

Analyzing Competitive Landscape

Understand the competitive landscape in which the startup or small business operates. Assess the strength of existing competitors, potential future entrants, and any barriers to entry. Evaluate the startup or small business’s competitive advantage and its ability to differentiate itself in the market.

Investment Opportunities in Startups or Small Businesses

Investment opportunities in startups or small businesses can span various sectors and industries.

Technology Startups

Technology startups offer exciting investment opportunities due to their potential for disruptive innovations. Areas like software development, artificial intelligence, biotechnology, and renewable energy present compelling prospects for investors seeking high-growth ventures.

Social Impact Ventures

Investing in social impact ventures allows you to generate financial returns while contributing to positive societal and environmental change. Startups and small businesses focused on areas such as sustainable agriculture, renewable energy, healthcare, and education provide opportunities to align your investment goals with positive social impact.

Franchise Opportunities

Franchise opportunities offer a relatively low-risk way to invest in small businesses. By investing in established franchise models with proven success, you can leverage the brand recognition, operational support, and training provided by the franchisor.

Emerging Markets

Investing in startups or small businesses in emerging markets can provide significant growth opportunities. These markets often have favorable demographics, growing middle-class populations, and untapped consumer segments. However, investing in emerging markets also carries unique risks, such as political instability and regulatory challenges.

Government Incentives and Support Programs

Governments often provide incentives and support programs to encourage investment in startups or small businesses.

Tax Breaks and Incentives

Many countries offer tax breaks and incentives to investors supporting startups or small businesses. These can include tax credits, deductions, and exemptions on investment capital or profits. Familiarize yourself with the specific tax regulations and incentives available in your jurisdiction.

Grants and Subsidies

Governments and non-profit organizations often provide grants and subsidies to startups or small businesses in specific industries or sectors. These grants can help cover research and development costs, prototype development, and market expansion. Stay informed about available grant programs that align with your investment preferences.

Incubators and Accelerators

Incubators and accelerators are organizations that support the growth of startups through mentorship, networking opportunities, and access to resources. Some incubators and accelerators may also offer investment opportunities. Consider partnering with these organizations to gain exposure to promising startups and small businesses.

Successful Examples of Startup Investments

Successful startup investments have the potential to generate exceptional returns. The following examples demonstrate the significant growth and success that can be achieved through investing in startups:

Investors who believed in Google’s vision and early search engine technology reaped significant rewards. Since its initial public offering (IPO) in 2004, Google’s market capitalization has skyrocketed, creating substantial wealth for early investors.

Facebook’s rapid growth from a college social networking site to a global social media giant has made it one of the most successful startup investments in history. Early investors in Facebook realized substantial returns when the company went public in 2012.

Microsoft

Investors who had faith in Microsoft’s software and technology platforms from its early days have benefited from its consistent growth and innovation. Microsoft’s success as one of the world’s largest technology companies showcases the potential rewards of long-term startup investments.

Amazon

Amazon’s transformation from an online bookstore to a global e-commerce powerhouse has made it one of the most valuable companies in the world. Investors who recognized its potential early on have experienced remarkable returns on their investments.

Conclusion

Investing in startups or small businesses can provide exciting opportunities for financial growth, personal involvement, and supporting innovation. However, it is essential to carefully consider the risks, evaluate various factors, and implement effective investment strategies.

By assessing market potential, evaluating the management team, understanding the different types of investments, and conducting thorough due diligence, you can increase your chances of making successful investments. Additionally, staying informed about government incentives, exploring different investment vehicles, and diversifying your portfolio can help maximize your overall returns.

While investing in startups or small businesses carries risks, the potential rewards can be significant. By being diligent, informed, and proactive, you can seize investment opportunities and participate in the dynamic and ever-evolving world of startups and small businesses.